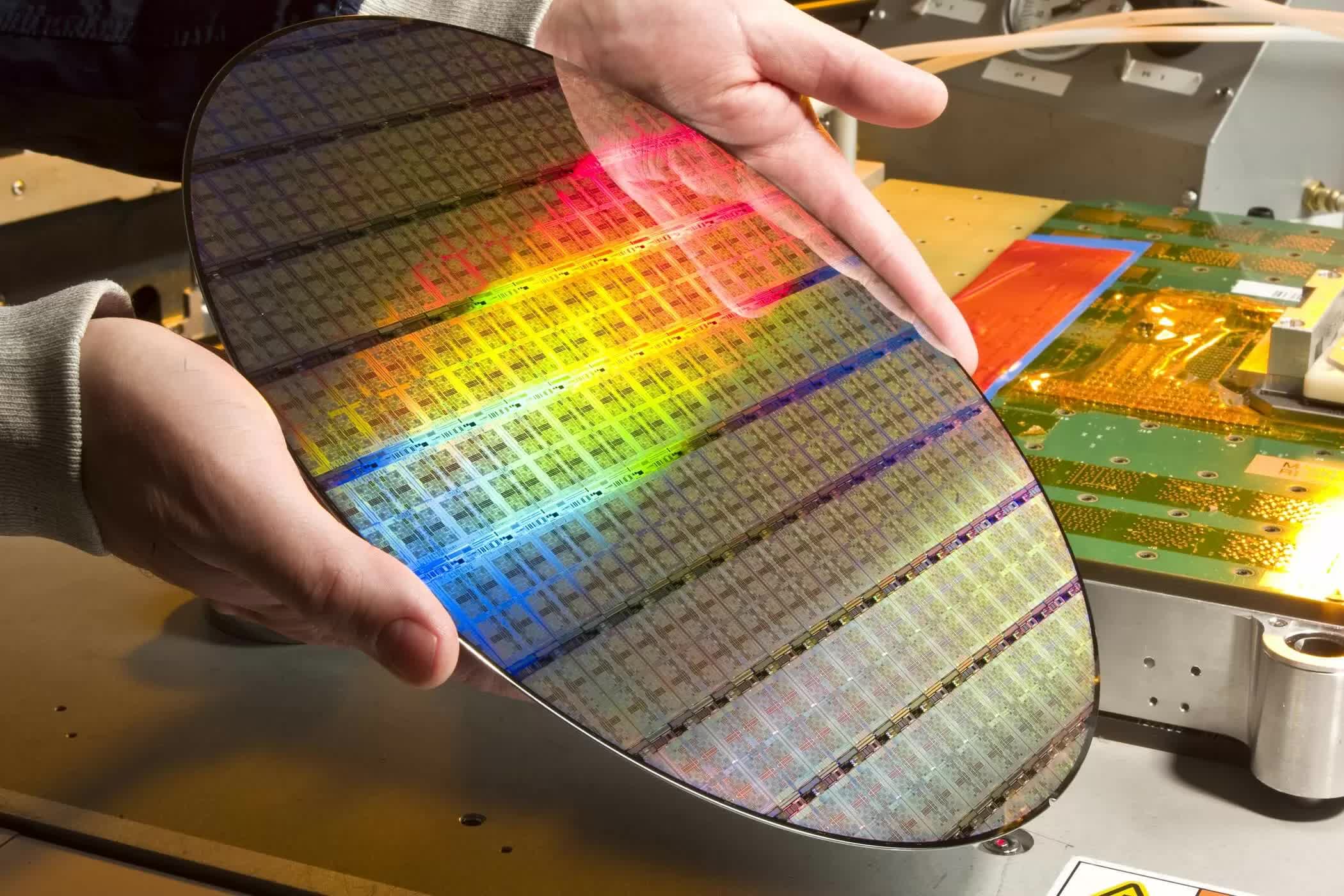

Not Looking Good: Samsung is one of the few companies in the world with true chipmaking capabilities. However, the foundry division of the South Korean conglomerate is struggling significantly in its efforts to expand processor manufacturing operations in the US.

Samsung is reportedly delaying the completion of its chip manufacturing plant in Taylor, Texas, due to a lack of customers for its foundry services. According to industry sources cited by Nikkei Asia, the South Korean corporation's ambitious plan to launch a major new US foundry operation is already backfiring.

The facility was originally slated to open in 2024 but has now been officially pushed back to 2026. Documents from Samsung C&T, a Samsung affiliate overseeing construction, show that the project was nearly complete as of March – reaching 91.8 percent completion. However, Samsung has not begun installing chip manufacturing equipment, as it would currently sit idle.

A supply chain industry source reportedly confirmed that Samsung is in no hurry to finish the Taylor plant. Local demand for advanced chip production is insufficient, the source said, and the process nodes originally planned for the facility are now largely outdated. To move forward, Samsung would need to significantly revamp the site's capabilities, an expensive undertaking with no guarantee of short-term return on investment.

Samsung initially planned to manufacture 4nm chips at its Taylor, Texas, facility but later announced plans to upgrade to a more advanced 2nm process node. The company originally committed $17 billion to the project, but over the past few years, that investment has ballooned to $37 billion across the broader Texas region. This includes $4.7 billion in subsidies granted under President Biden's CHIPS and Science Act.

However, the new Trump administration is actively working to dismantle the CHIPS Act and other semiconductor funding programs established during Biden's term. Compounding the challenges, Samsung has reportedly faced poor manufacturing yields with its 2nm process, another factor contributing to delays at the Taylor facility.

According to TrendForce analyst Joanne Chiao, Samsung's 2nm yields have improved, but the company continues to face internal and external hurdles in expanding its US foundry presence. The Taylor plant is expected to produce chips for smartphones, PCs, and consumer electronics, yet current demand in those sectors remains weak.

Samsung continues to trail behind TSMC in the global foundry market. The Taiwanese giant dominates production of advanced chips such as GPUs and AI accelerators, driven by strong demand from data centers and tech firms. While the Taylor facility may eventually support limited production thanks to government subsidies and tax incentives, Chiao suggests that Samsung's original ambitions are likely postponed well into the future.